If you follow trends coming out of China, you may have heard of “C2M,” or consumer-to-manufacturer, a new business model being touted as a revolution in the retail industry.

C2M is a model in which large e-commerce firms take big data analytics from their enormous userbases and pass them on to partners in manufacturing. These manufacturers can then identify market trends in real-time, adjust production based on those trends, and sell their products on the same e-commerce platforms that supplied them with the data. In theory, this reduces links in the supply chain while cutting expenses for things like market research, ultimately providing the consumer with a tailored product at a low price.

Who are the major players behind C2M, and is the hype about it true? Read below for our analysis on this trend.

In The News

A quick search of C2M on Google will call up articles describing a new model in China, primarily used with e-commerce, that uses big data to connect consumers directly with manufacturers. Sites like TechNode describe it as a consumer-driven approach that allows for the “production of tailored products at lower prices.” Chinadaily emphasizes C2M’s ability to reduce links in the supply chain and promote development of the manufacturing industry. The MIT Technology Review, in a more nuanced article, points out how it can help manufacturers partner with large e-commerce platforms to diversify their income sources in an environment of falling exports. At the same time, it questions if China’s domestic market is strong enough to compensate for uncertain access to foreign markets, and if C2M isn’t actually just a “savvy push from e-commerce giants to grow their own platforms.”

To gain a better understanding, let’s take a look at what three top e-commerce platforms are doing and saying about C2M.

The Players

E-commerce platforms in China are using C2M in different ways to compete for market share in this highly competitive space. The main underlying component is the use of big data analytics to assess consumer trends in real-time, and passing that information on to manufacturers. Here we look three e-commerce platforms that are making use of C2M: Pinduoduo, Jingdong and Alibaba.

Pinduoduo

One of the first major e-commerce platforms to successfully use C2M is Pinduoduo. What makes Pinduoduo unique as a platform is its group purchasing feature. When purchasing a product, users can choose to buy as a group and drive down the price. In a group purchase, a certain threshold of buyers must be met within the time limit for the sale to succeed and the order to be placed. If there isn’t enough demand for the product, group sale is canceled. Users can still buy the product individually, but at a higher price. This encourages users to share products they’re interested in on social media, encouraging friends to purchase with them.

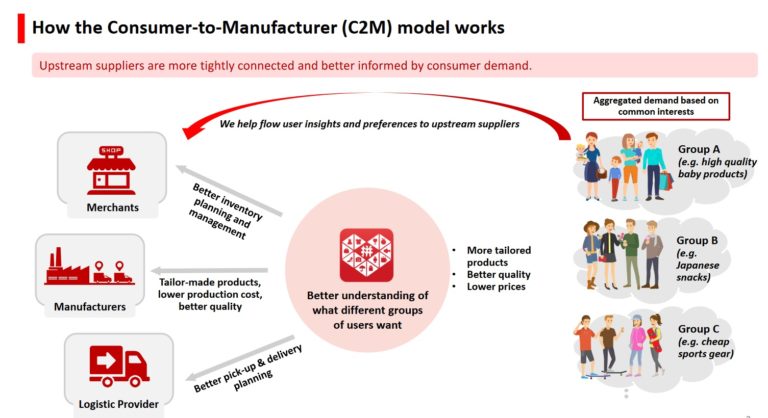

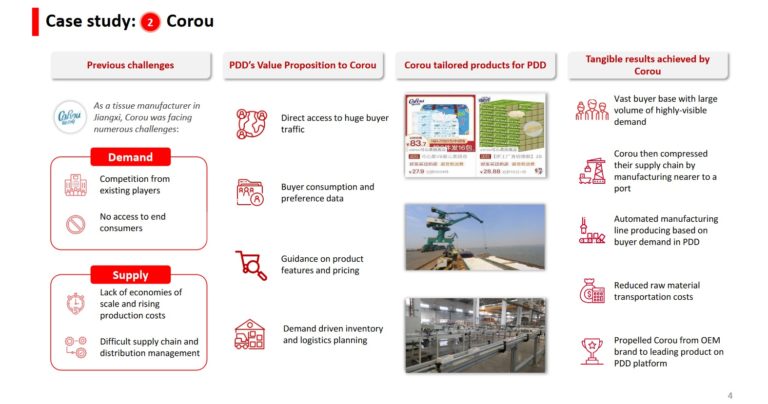

These images, from Pinduoduo’s investor relations department, describe the platform’s C2M model in their own words.

Pinduoduo provides user insights and logistical support to manufacturers, who can then adjust their product offerings with confidence based on consumer demand. Pinduoduo helps sell participating manufacturer’s products on the platform via preferential placement and marketing efforts such as livestreaming.

We also see terms such as “New Brands,” referring to OEM or third-party manufacturers that are rebranded in this process to sell directly to consumers.

Alibaba

The largest e-commerce platform in China, Alibaba recently gained publicity for using C2M when they announced their “Spring Thunder” plan earlier this year. A support measure for SMEs suffering from the Covid-19 economic turndown, Alibaba said the plan would assist export-focused factories across China with launching their own brands and help them achieve 10 million RMB in annual revenue on Tmall, Alibaba’s B2C platform. (In April, we translated an article that discusses Tmall and the Spring Thunder plan.) Using words like “incubate” and “brand transformations,” one key focus of Alibaba’s message is on investing funds to help struggling manufacturers adapt to new economic conditions.

Armed with Alibaba’s user insights and a new brand image, these manufacturers can design products based on consumer demand and sell them on Tmall, which helps with marketing and promotion on the platform. Alibaba’s extensive distribution and logistics network also means the manufacturers don’t have to worry about the product once it leaves their facilities.

In this image, from an Alibaba Investor Day presentation in September 2019, we can see some other ways in which C2M is being described and marketed. Highlighted in green are terms used in their main messaging such as “Made-to-Order Factory,” “On-Demand Manufacturing” and “Customized Products.” C2M, meanwhile, is hidden in the fine print, the sourcing strategy that underlies these new initiatives.

Jingdong

Jing Dong, also known as JD, first made its name selling electronics. It has since moved into other sectors and is one of Alibaba’s largest competitors. Like Alibaba, JD is also using C2M to partner with factories, taking advantage of user data to inform production and increase sales.

Similar to Alibaba, it provides market research and consumer insight to manufacturers, who then adjust product offerings to sell on JD’s website. Rather than focus on assisting third-party factories with creating their own brand, JD works more with branded manufacturers on the backend to enhance products based on consumer demand. One notable example is laptops, an industry that JD is intimately familiar with. Using their massive data on consumer preference and market trends, they have worked with the likes of Hewlett Packard, Lenovo and Thunderbot (雷神, one of China’s leading gaming computer companies) on new product development.

Another example, from a 2019 Q2 report: “JD also worked with top food and beverage company Nestlé on two C2M projects. Using insights from JD, the brand was able to optimize the flavor of its Purinacat food as well as its wafer bar packages to support customer needs for a larger variety of flavors.”

A Boon for E-Commerce Platforms

The name “Consumer to Manufacturer” implies an interaction initiated by consumers, who are typically on the passive end of traditional B2C models. Because C2M uses user data to inform production decisions, it is often described as consumer-driven or as putting power in the hands of consumers. There is a degree of truth to this, but in our opinion the emphasis is misplaced.

In reality, it is the large e-commerce platforms that are aggregating user data to assist partner factories in reducing production costs and catching consumer trends. For some time, e-commerce platforms have been replacing traditional retailers and taking ever-increasing ownership over logistics and distribution channels. In the C2M model, these platforms are also eliminating the need for market research by using big data to identify consumer trends.

By providing this information directly to manufacturers, they eliminate the need for any other link in the supply chain, including brands. Manufacturers gain access to massive consumer data without the typical costs of large-scale market research, allowing them to design and produce their own products.

In some models, such as Alibaba and Pinduoduo, the e-commerce platform then helps the factory with their own branding and marketing (such as livestreaming and featured pomotion) on the platform, and what was once a third-party manufacturer becomes a vertically integrated, consumer-facing brand. The e-commerce platform, for their part, earns more sales on their site and improved user experience. This, ultimately, leads to more data, and the cycle repeats.

Looking Forward

As talk of consumer-driven supply chains grows, the C2M model could certainly have a place in the future of retail. Should it actually take off, we have to wonder where it leaves traditional brands selling on e-commerce. For example, if two similar products appear in a user’s search result, one from a traditional brand and one from the e-commerce platform’s C2M partner factory, does the partner factory get preferential placement or a “featured” tag? Similarly, if the e-commerce platform is providing user insights at no or low cost to the partner factory, do they have an inherent pricing advantage over brands that invest heavily in market research and product design?

The answers will depend on how the e-commerce giants handle the specifics of these deals. Alibaba’s New Retail concept has gained publicity for its flashy, smart-tech retail concepts, but in English media there has been little talk of the fact that they actually unveiled 5 “New” concepts. Including retail, the others are New Energy, New Tech, New Finance, and, of course, New Manufacturing. It seems that Alibaba’s C2M model, similar to many of its New Retail innovations, is an attempt to use big data to revolutionize what it sees as an outdated industry. In the process, it is embedding itself in or simply taking over as many links as it can in the chain between manufacturer and end user.

It’s clear that these companies are serious about pushing new models to grow their business. For now, this is one area where innovation is stronger in China than the US. How far these new concepts can go and how much they can truly revolutionize their industries remains to be seen.